Fraud can happen to any business at any time. It is not limited to the financial industry or a particular type of business. Fraudulent activities can range from simple scams to complex cybercrimes that can cause significant financial damage to individuals and businesses alike. This is why investing in a fraud prevention solution should be a cybersecurity imperative for any business.

Types of fraudulent activities

Even with the advancement of technology and security measures, fraudulent activities remain a pervasive issue across various industries. Some of the common types of fraudulent activities include:

- identity theft (stealing Social Security numbers, for instance)

- payment fraud (the theft of bank account information, credit cards, phone number, or fraudulent transactions)

- bank fraud (setting up fraudulent accounts, taking out loans, etc)

Scammers use various methods to commit these crimes, including exploiting vulnerable online systems and stealing personal or financial information via data breaches. It is essential to understand these types of fraudulent activities and their underlying methods in order to effectively prevent them from happening.

Digital and online fraud

In today's digital age, online fraud has become a widespread problem, with many people becoming a victim of identity theft and other scams. Fraudsters use various tactics to scam individuals and businesses, such as phishing scams, fake websites, and social engineering attacks. Phishing scams involve tricking individuals into revealing personal information through emails or texts that appear legitimate.

Fake websites can also deceive people into providing sensitive information or making payments on an imposter site that mirrors popular brands. Social engineering is another technique used by fraudsters to manipulate individuals into divulging confidential details or performing actions that benefit the attacker.

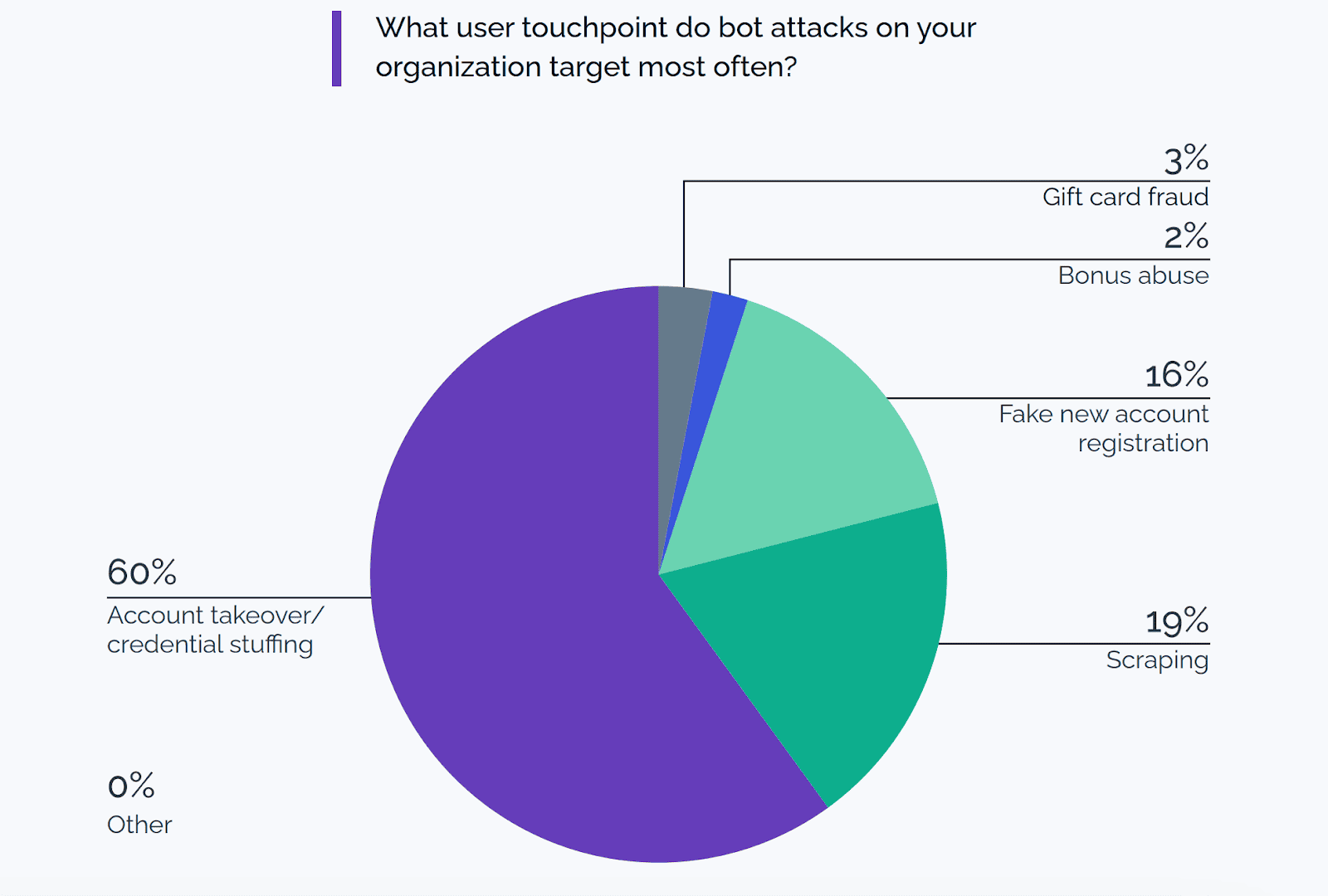

The role of bots in cybercrime and fraud

With the rise of automation and technology, bots have become a common tool (and the best way) for scammers to carry out fraudulent activities on a large scale. These automated software programs can be used for various types of fraud, including phishing, identity theft and credit card fraud. Making matters more difficult is that many of these advanced bots can be purchased by cybercriminals on online marketplaces, often known as bots-as-a-service. Additionally, these bad bots have gotten more sophisticated and can even mimic human behaviors, making them more difficult to detect.

Fraud prevention techniques

Preventing fraud is essential for businesses but also for any victim of fraud. There are several techniques that can be employed to prevent fraudulent activities, when red flags occur, such as using multi-factor authentication and strong passwords to protect sensitive information. It's also important to train employees on keeping work a safe place and how to identify and report potential fraud attempts, conduct regular audits of financial transactions, and implement strict data access controls. By staying up-to-date with the latest fraud prevention technologies and strategies, individuals and businesses can stay ahead of the curve and protect themselves against potential threats. Here are some common prevention techniques for businesses to take:

Employee education and training programs

Proper employee education and training programs are crucial to prevent fraud in any organization. By providing employees with the knowledge and tools necessary to identify and report suspicious activities, companies can greatly reduce their risk of falling victim to fraudulent schemes. These training programs should cover topics such as how to handle sensitive information (think bank statements, account numbers, etc), detect fraudulent attempts, and understand company policies and procedures related to fraud prevention. Regular training sessions can reinforce the importance of fraud prevention and keep employees updated on new threats and emerging best practices.

Two-factor authentication

In today's digital age, it's more important than ever to ensure the security of online accounts, especially for a financial institution or online retailer. Two-factor authentication is a powerful tool for preventing fraud and protecting sensitive information from cybercriminals. By requiring a second form of verification, typically sent via email or text message, in addition to a password, two-factor authentication adds an extra layer of security that can help prevent unauthorized access to your accounts. This robust security feature can be enabled on many online services, making it easy to set up and use. It's a simple but effective way to safeguard your personal and financial information online.

Regular updates and maintenance

Maintaining the security of your systems is an ongoing process that requires regular updates and maintenance. By keeping your operating systems, applications and antivirus software up to date, you can prevent security vulnerabilities that could lead to fraud. Regular monitoring and review of financial statements can also help identify any suspicious activity before it becomes a problem. Implementing strong password policies and limiting access to sensitive information can also reduce the risk of fraud. Educating employees on fraud prevention techniques can help create a culture of awareness and vigilance, ultimately helping to prevent fraud.

Bot management

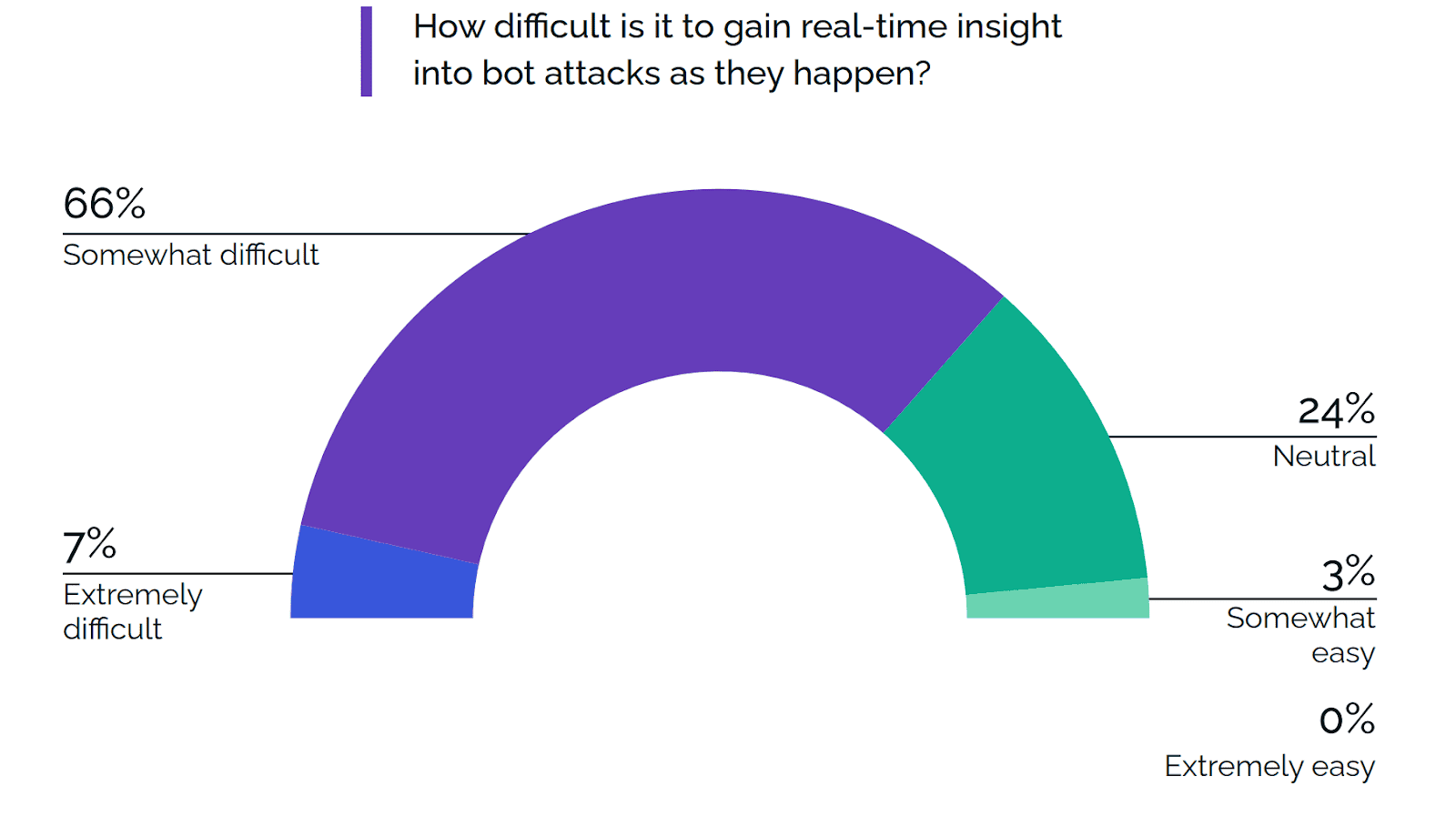

Bot management is a crucial aspect of fraud prevention in today's digital world. Fraudulent bots can be used to steal sensitive information or engage in other malicious activities on websites or applications. Bot management solutions utilize techniques such as CAPTCHA challenges, device fingerprinting, and behavior analysis to detect and block fraudulent bots. Regularly monitoring website traffic, including differentiating between human and non-human traffic, is also an important aspect of bot management. As such, it's important to choose a reliable bot management solution that fits your organization's needs to protect against bot-driven cybercrime.

Fraud prevention with Arkose Labs

Preventing fraud requires a multi-pronged approach that includes employee education, regular updates and maintenance, two-factor authentication, strict data access controls, and bot management. With the increasing prevalence of digital and online fraud, it has become essential to be proactive in protecting your business from malicious activities.

The Arkose Labs’ Platform classifies traffic based on the underlying intent of users and deploys appropriate countermeasures to remediate attacks in real time. Arkose Labs goes beyond stopping fraud attempts and attacks to deliver a long-term solution that deters cybercriminals while enhancing the good user experience for legitimate consumers.

In-depth protection with Arkose Labs enables businesses to take a zero-tolerance approach to fraud and abuse on their websites and apps, while enhancing user experience and customer loyalty.

Suspicious traffic is targeted with tailored Arkose MatchKey challenges that puts the right amount of pressure on fraudsters’ ROI without blocking the good user experience. Designed to deter large-scale attacks at the gateways of fraud, Arkose Labs enables retailers to eliminate fraud from their ecosystem early, reduce stress on any payment or account creation flows, and increase trust from consumers.