It is estimated that cybercrime will cost businesses losses worth $10.5 trillion by 2025.¹ These are massive losses which businesses cannot keep absorbing indefinitely. They need defense mechanisms that can help arrest financial and reputational losses as well as adequately protect their business and customer interests.

There are many legacy and point solutions available on the market that are no longer effective in providing the level of protection that modern digital businesses need. This is because attack tactics are continuously evolving and these subpar solutions have failed to keep up. Therefore, digital businesses need defense mechanisms that are technology-driven and follow a white-box approach, providing businesses with actionable insights that help build capabilities to tackle evolving challenges head-on.

Fortunately, advancements in technologies such as artificial intelligence, machine learning, behavioral biometrics, device intelligence, big data analytics, are proving helpful in fighting complex and evolving threats. Fraud detection solutions leveraging these technologies help businesses to evaluate hundreds of parameters to detect anomalies and suspicious behaviors. Further, with self-learning capabilities, these solutions can adapt to the new attack types.

There are several considerations that digital businesses must bear in mind while choosing a fraud detection software such that they can effectively balance fraud detection with user experience and get the best value for their investments.

What is fraud detection software?

Fraud detection software is a general term used to refer to solutions that help detect suspicious user activity and illegitimate online transactions. Fraud detection software analyze user actions and assess the risk associated with each user to inform further action – whether to allow the user to proceed further or to engage the user in further investigation.

Given the growing instances of fraud, it is critical that digital businesses implement effective fraud detection software to spot fraud attempts early in their tracks and protect their customers. Fraud detection software have become an important ingredient of fraud risk management strategy, as several regulations require businesses to deploy robust security measures to safeguard user data, failing which they may be subject to penal action.

What do fraud detection software do?

Fraud detection software help businesses protect their platforms and customers from malicious activity. These solutions monitor user activity to assess the risk associated with each user and assign a risk score. They compare user behavior with the standard behavior – specifically defined by each organization according to their unique business needs – to allow or reject the user further access. For instance, anomalous transactions – that deviate even slightly from the standards – are not allowed to proceed further before additional investigation.

Fraud detection software use machine learning rules and models to assess users and trigger alerts for suspicious users to enable security teams to take appropriate next steps.

Benefits of fraud detection software

As the volumes and complexity of attacks continue to increase, manually reviewing every incoming user is nearly impossible. Manual reviews not only require a lot of human effort but are also time-consuming, which can cause delay in processing user requests. This can prove costly as today’s customers expect instant response, and any delay can cause customer annoyance – an undesirable proposition for a business. Further, manual reviews are prone to errors and human-biases that can impact the overall results, leading to false positives and false negatives, again impacting user experience.

With the ability to automatically analyze incoming traffic to a digital platform, fraud detection software have become a key weapon in the fight against fraud. Some of the key benefits that fraud detection software offer are as described below:

- Screen transactions in real-time: Fraud detection software leveraging ML capabilities can monitor incoming traffic non-stop 24x7. This helps speed up the analysis and improve user experience. It also alleviates the burden of manual reviews, freeing up the security teams to engage in more productive and core business activities. Furthermore, it saves companies the overhead costs incurred on maintaining large teams to manually review incoming traffic.

- Gain insights: Fraud detection software can analyze user behaviors and identify patterns in real-time, which provides useful insights to help spot early indicators of fraud and deploy appropriate countermeasures in time.

- Reduce false positives: Efficient fraud detection software analyze a number of parameters to accurately identify genuine users and authenticate their online transactions, thereby reducing false positives.

- Track and report performance: Most fraud detection software today have in-built dashboards to help businesses monitor the performance in real time. These dashboards create in-depth reports with granular details to enable businesses make data-backed decisions and improve existing rules, if needed for better protection.

How many types of fraud detection software are available?

Fraud detection software can be broadly classified into two types, namely: transactional and sessional.

The transactional systems enable businesses to analyze the parameters needed to assess payment risks, which can help protect them from fraud attempts. Based on the results of this analysis, users may be allowed or flagged for further investigation.

The sessional systems analyze digital intelligence collected during user activity of the device to ascertain whether the action conforms to the defined standards. In case device activity deviates from the standard, it is categorized as a possible fraud attempt and further review is triggered.

Organizations can choose the most appropriate type of fraud detection software depending on their unique business needs and the type of customer base they service. A lot of organizations also use a mix of transactional and sessional systems to fortify their defenses. Although most vendors offer either transaction or sessional systems, there are platforms that can help integrate both the capabilities. That said, such integrations may be costly and face communication glitches.

How to choose fraud detection software?

Driven by the growing willingness of businesses to invest in fraud detection software, the global fraud detection and prevention market is projected to reach $65.8 billion by 2026². This will result in a proliferation in the fraud defense tools available. Businesses would, therefore, need to carefully and critically choose fraud detection software that is aligned with their overall security strategy and helps fight evolving fraud, while delivering exceptional user experience.

When choosing fraud detection software, businesses must consider the features and several other aspects, which allows them to realize the most optimum defenses against rising threats. Not only should fraud detection software be able to effectively fight fraud, it should be cost-effective and user-centric.

Some of the features that organizations may consider while choosing fraud detection software include:

- Level of automation: Depending on whether the company would outsource fraud prevention or manage it in-house.

- Deployment: Fraud detection software can be deployed both in the cloud and on-premises. Cloud-based fraud detection software are quicker to deploy and ensure compliance with the prevailing regulations. Various pricing models are available and organizations can choose a model that best fits their requirements. The on-premise fraud detection software is installed at the organization’s location, and therefore, requires a complete infrastructure complete with tools and analysts, which increases the cost of deployment for the organizations. However, the organization has complete control over the information which remains within their premises.

- Integration: The fraud detection software should be compatible with the company’s digital platform such that it can integrate seamlessly.

- Communication: A good fraud detection software is able to communicate efficiently with external data sources, which facilitates aggregation and verification of transactional data against databases and blacklists.

- Flexibility to create/modify rules: Fraud detection software must offer the flexibility to configure the system independently. They should feature an intuitive rule builder to allow building and modifying rules instantaneously even for the non-technical staff.

- Speed: A good fraud detection software can quickly assess risk to instantly trigger action alerts. It should be able to perform informed and efficient velocity checks to monitor suspicious activity in a specified duration.

- Transparency: Fraud detection software that follow the blackbox approach provide little to no insights on why a user or session was deemed risky. They do not offer data to explain the rationale behind the risk scoring or decisioning, leaving little scope for improvements in the future responses. Fraud detection software that adopt whitebox approach can transparently explain the decision-making process, enabling security teams to gain actionable insights to help adapt to the evolving threats.

- Prevention of fraud across channels: As consumers are increasingly shopping on the go, using mobile phones, it is essential that fraud detection software features adequate support for mobile use cases, with the ability to monitor user activity from mobile devices.

- Comprehensiveness: Fraud detection software must be versatile that can help fight diverse and evolving attack types to provide maximum protection in the long-term. It should have self-learning capabilities to quickly adapt to the new types of cyber threats.

- Regulatory compliance: Fraud detection software must comply with the data security requirements such as GDPR and GLBA.

- Cost effective: Depending on the level of support various pricing models are available: fixed subscription plans, flexible pricing, or pay per use. Choose the fraud detection software that fits the overall security budget.

- Timely support: One of the crucial considerations is the ability to reach the provider whenever support is needed. Understand the onboarding process, check service level agreement, enquire about how to report a problem, average response time, and service unavailability (if applicable).

- Reliable vendor: Choose a fraud detection software that is backed by a reliable vendor, such as Arkose Labs. A responsive vendor that provides timely support is an effective partner in the fight against evolving threats.

Arkose Labs is the partner of choice

As cyberattacks continue to grow more complex, there is a deluge of fraud detection software on the market. Therefore, choosing the right fraud detection software is critical to quickly responding to the moving target without disrupting user experience, while also alleviating the burden of the security teams.

Leading global brands trust Arkose Labs to fend off these sophisticated attacks and protect their customer-facing touchpoints in a customer-centric manner such that there is no undue friction for genuine customers. Arkose Labs’ platform integrates seamlessly with the leading third-party applications, which allows for simple and agile implementation, onboarding, and optimal performance without the need for on-site hardware.

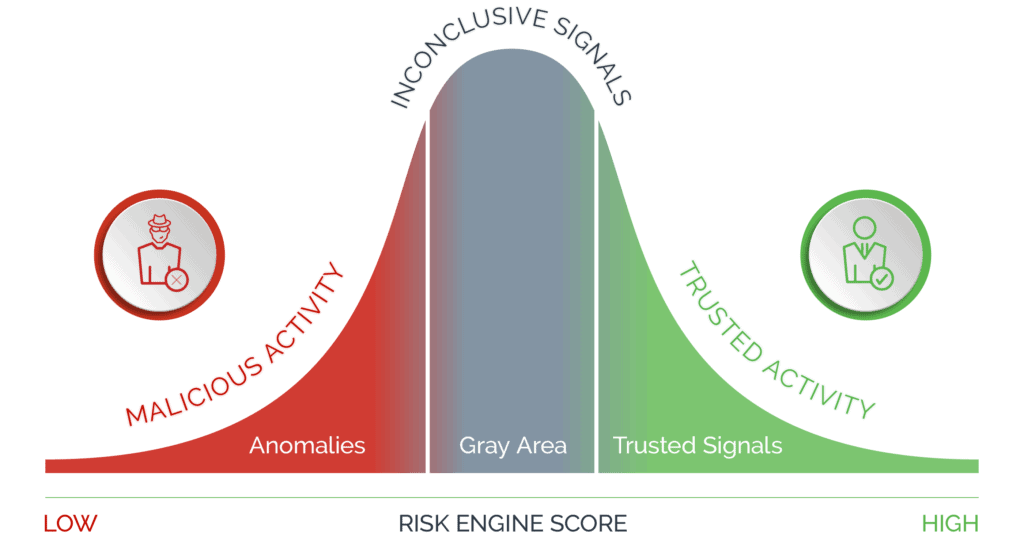

Using machine learning-powered decisioning, behavioral biometrics, and a large repository of user-friendly challenges, Arkose Labs allows trusted users to pass through without friction while orchestrating a targeted attack response for suspected fraud. Adopting a multi-layered approach, Arkose Labs dynamically evaluates traffic in real-time, segments it based on suspicion level, and delivers an appropriate response to accurately identify and block all automated attacks.

Traffic with risky or inconclusive signals – that cannot be categorically termed good or bad – is administered the Arkose Matchkey challenges to ensure no good user is stopped and no malicious user can sneak through. With its innovative defense-in-depth approach, Arkose Labs detects bots of all sophistication levels and can adapt to the full range of bot attacks and monetization tactics.

User-centricity is central to Arkose Labs. Therefore, we help businesses deploy robust defenses early in the customer journey without impeding good user throughput, so they don’t have to trade off between security and growth.

Transparency is at the core of Arkose Labs solution. Instead of simply providing a probabilistic risk score with little information, Arkose Labs shares detailed attributes about high-risk traffic with recommendations on the best measures to address the attack signature. Our solution provides extensive data on the device, network, and user behavior.

Arkose Labs believes in true partnership, providing businesses with 24/7 SOC to help them address any issue instantaneously through customized solutions and actionable insight pertaining to the specific issues they are seeing. Each client also has their own dedicated Slack for any time communication with the team they work with at Arkose Labs.

Arkose Labs holds itself accountable to stopping automated attacks and therefore, backs its solution with an industry-first warranty against credential stuffing attacks, which includes up to $1 million recoverable for covered losses and a 48-hour remediation guarantee. This is in addition to the existing 100% SLA guarantee around automated attacks.