The primary responsibility of a board is to protect shareholder value. That role has become increasingly complex, as security, fraud, and compliance have all amalgamated. Compliance has emerged as a bigger challenge, globally and CEOs, CFOs, and CTOs risk criminal liability in case of a lapse.

One incident of a data breach can result in loss of IP, revenue, and customer confidence; resulting in negative publicity can ruin a brand's reputation. Boards are particularly sensitive about bad press, as it affects the shareholder value. A fully-electronic work-from-home environment introduces new security fault lines. It is of utmost importance that fraud be tackled effectively with security and compliance working well together.

How to make fraud prevention a strategic conversation?

There is still a pressing need for educating the board on fraud—what it means and why it is important to fight it. Board members must be made aware of the far-reaching implications of fraud and how this challenge should be managed.

Fraud can take different forms for different organizations. For instance, fraudsters are pretending to run a business or someone may misreport the actual performance of the business. Each type of fraud has a different implication. Taking such different forms, it’s a real challenge to stop all fraud.

Apart from educating the board on fraud; the fraud conversation with them must include a well-crafted action plan complete with clearly defined goals and the threshold for fraud. An understanding of the responsibilities and liabilities of each board member and the key drivers that board members think about while guiding their teams into growth can help frame fraud conversations more meaningfully.

Strategic drivers that help make informed decisions

Pertinent questions like ‘can you lose money’ or ‘can you get into regulatory trouble’ are good prompts to start the fraud conversation. Whether you’re a board member, a founder, or a company employee—fraud prevention is everyone’s responsibility. For many companies—banks and ecommerce companies in particular—fraud is a cost of doing business. A line item for anticipated losses and high potential payouts are the right incentives for fraudsters to engage in malicious activities.

In the past, fraud would just mean a loss of revenue; now it also impacts brand loyalty. Today, if consumers learn that their accounts have been hacked or credit cards were misused, they may not go back to that company again. Therefore, educating the board on fraud and its impact will help them understand the risk of losing the lifetime value of a customer due to fraudulent activities.

Since boards approve business plans and budgets, the operating staff must present a budget to the board that includes the ability to stand up to fraud, security, and compliance. They must convince the board of the importance of these activities; although they are non-revenue generating, they are in many cases revenue protecting.

Digital commerce is undergoing a fundamental change

The COVID19 pandemic has changed how business is done. With inclusive recovery, people are experiencing an accelerated digital transformation of their businesses. This is paving the way for fundamental changes in the digital commerce landscape. Perceptions and expectations of consumers have changed and businesses must take a digital-first approach. Everything from growth to business risk is being re-imagined. With digital-first experiences, businesses must authenticate their customers through new and different methods. Interesting innovations allow businesses to manage identities and fraud without actually being able to see the person.

The work-from-home phenomenon will likely have a permanent impact on managing enterprise software systems. Enterprise application systems feature in-built security parameters from identity verification to access management — and protect against network attacks and phishing. However, the lack of service support is driving the rapid adoption of Software-as-a-Service (SaaS) products like Arkose Labs. SaaS vendors build in that security and necessary identity management so businesses can pass through the responsibility for dealing with network intrusions

Customer expectations have also changed

Like businesses, consumers have been shifting to online experiences. Consumers expect an almost frictionless experience when it comes to online purchases. To fight fraud, businesses might introduce friction to block suspicious transactions, which can result in negative customer sentiment.

In an effort to increase their customer base and make the customer journey seamless, many businesses lower the guards. Because businesses are keen to welcome any and every early adopter, fraudsters exploit these security gaps to game the system for financial gain! Businesses must be able to balance fraud prevention and regulatory compliance with holistic user experience to prevent online abuse.

Elevate the conversation with the board

Walking the tightrope between strong security and easy user experience is a challenge and businesses must leverage advanced measures to provide that balance. They must improve their accuracy and detection and add friction to any fraudulent activity. Remember, fraudsters are smart and use the latest technologies to find the next weakness. They also keep changing the goalposts.

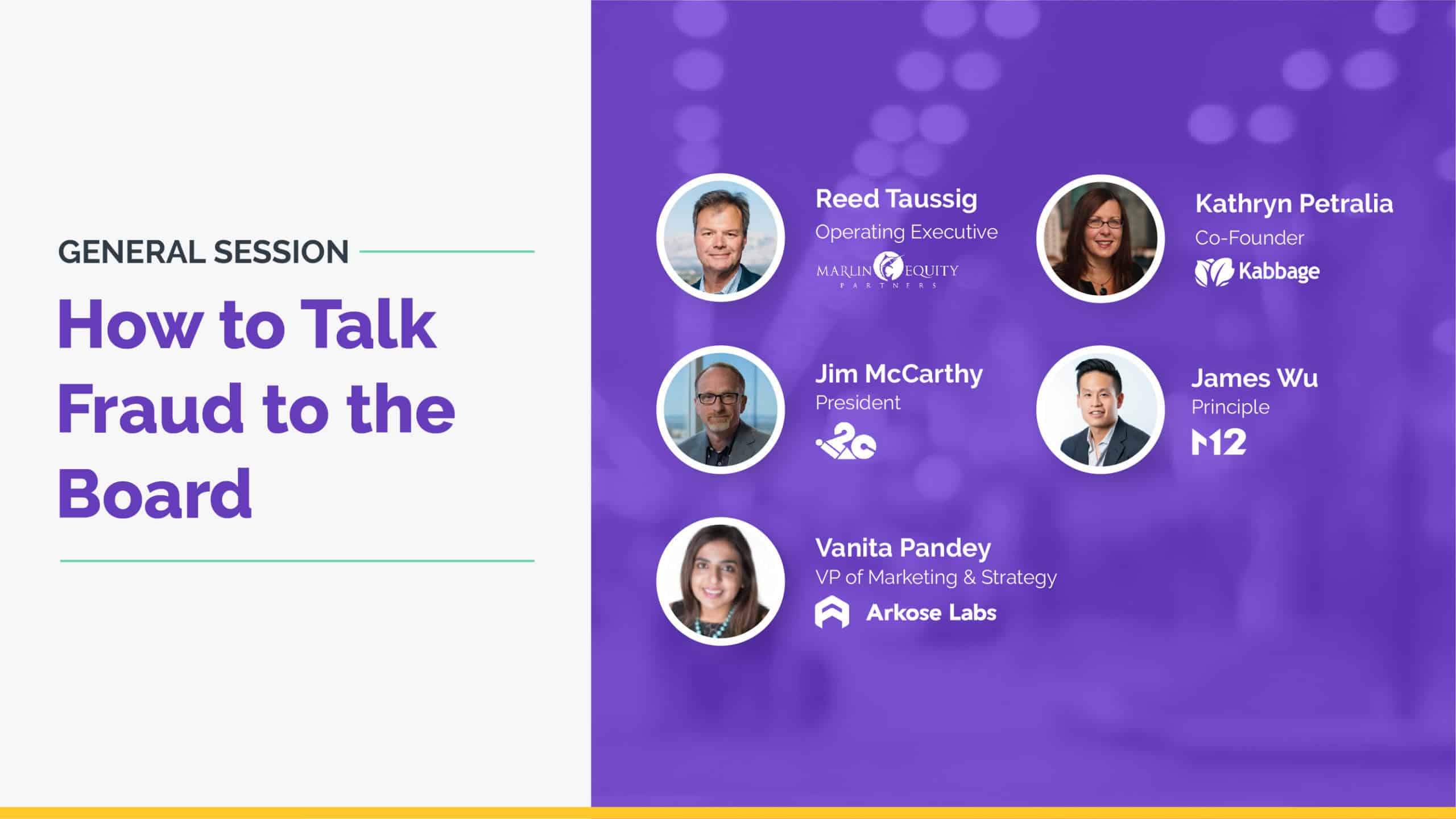

To hear eminent speakers share relevant and actionable insights on eliminating fraud, watch the on-demand recording of the Virtual Summit session "How To Talk Fraud to the Board".