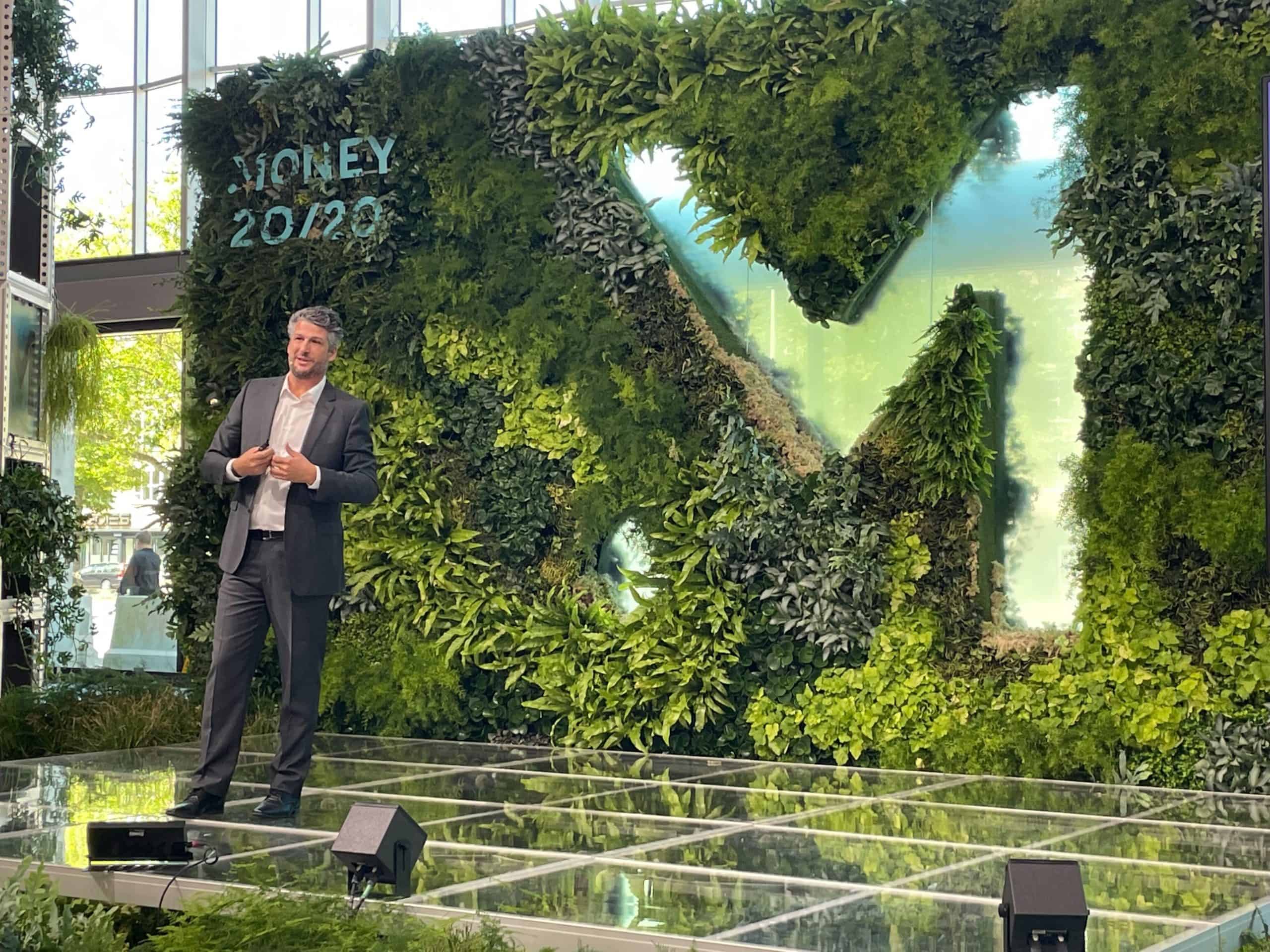

Money20/20 Europe 2022 was like none other. There were over 4,000 attendees from banking, fintech, payments, and financial institutions and included some of the most influential senior executives and risk analysts at the helm of anti-money laundering (AML) strategies, product management, threat intelligence, and more, sharing their insights and experiences.

Finance companies are a top target for attackers

The ‘wealthy’ finance sector is naturally at the top of the attack radar for bad actors. Our research shows that during Q1 2022, financial companies experienced 2.5 times more attacks than in the previous two years. With the growing adoption of digital payment methods, new credit options such as Buy Now Pay Later (BNPL), ease of opening new lines of credit, NFTs, explosion in the number of cryptocurrency platforms, etc., the attack vectors are only increasing.

The financial sector offers immense monetization potential and intelligent bots are making it easier – and cheaper – than ever before for attackers to scale up the attacks. A whopping 97% of the attacks on fintechs during the first quarter of this year were bot-driven. Even at a minuscule success rate, attackers can walk away with hefty profits.

Consumers’ financial accounts are prime targets for account takeover attacks because these compromised accounts can be used for money laundering, money muling, seeking loans, and a host of other financial fraud. Not only are attackers breaching consumers’ account security, they are also stitching together synthetic identities to create legitimate looking fake new accounts to fool businesses. Even if the fraud attempt gets detected, attackers can escape unscathed as fraud and security teams are left chasing a non-existent consumer.

Sit up and take note of synthetic fraud

The growing challenge of synthetic fraud is something that I spoke about at Money20/20 Europe during a panel discussion entitled ‘Movements in Synthetic Fraud andWhat It Means for Consumers and Businesses’. The interest around the topic was overwhelming with a great turnout during the session and the conversations that\ continued afterward. I’m grateful for the opportunity to share my thoughts and ideas with my fellow panelists on the future of Metaverse, Virtual Reality,Augmented Reality, and the security proposition in the advanced digital realm.

Empowering inclusivity in leadership

Another highlight of the event was the Rise Up panel session ‘Women in STEM….The New Sexy’. It’s an open secret that organizations having more women in leadership positions can add exponential value to the overall success of the organization. I am happy that Money20/20 gives due importance to both gender equality and creating equal opportunities for women colleagues to succeed.

I am proud of our own commitment to promoting gender equality and diversity within our company. The RiseUp session was a reiteration of this commitment, as we discussed ways and means to encourage more women to climb up the corporate ladder.

Smarter Detection Solution

It was heartening to see participants seeking out information on our smarter detection solution that can provide them with the visibility needed into the evolving attack tactics for efficient fraud prevention while keeping the user experience intact. They realize that the adversary is highly motivated and well-equipped with the latest tools. And that, traditional defense mechanisms can no longer provide the level of security they need in the wake of attacks becoming complex and targeted.

The Arkose Labs team managing our booth was also kept extremely busy. The team members interacted with the visitors and showed them how our Arkose Bot Manager platform provides smarter and more transparent detection, which ultimately forms the basis for a more robust and adaptive security posture.

Thank you for an interactive event

I am pretty sure that like me, participants at Money20/20 Europe have returned wiser with in-depth insights into the challenges digital fraud poses to the financial sector and what best practices we can adopt to fight this onslaught. My heartfelt thanks to the organizers, fellow panelists, participants, and members of the Arkose Labs team for putting together an interactive and interesting event. Thank you!