What is fraud mitigation?

Fraud continues to grow with an ever-increasing number of consumers engaging with digital channels to access various products and services online. Fraudulent activities disrupt business operations, cause financial and reputational losses, degrade user experience, and expose customers to repeat fraud.

Fraud mitigation is essential to protecting business and consumer interests. The actions performed by companies to reduce the risk and frequency of fraud are collectively called fraud mitigation.

Fraud impacts businesses and customers alike

Fraud can have a long-lasting impact on businesses and consumers. While businesses suffer direct and indirect financial losses, fraud can take a toll on consumers’ lives.

In addition to losing billions of dollars to fraud, businesses incur indirect costs such as those on remediation, customer support, password reset, and account restoration. Further, businesses run the risk of non-compliance to regulations that can result in hefty fines and legal action. Fraud can also dent the reputation of the company, which can lead to loss of market confidence, and ultimately new customer acquisition.

Why fraud mitigation is important

Fraud mitigation is critical to safeguarding the interest of the business and consumers. Not only do fraud mitigation efforts enable companies to reduce financial losses, they also send out a message to the customers that the company is serious about their account security.

Fraud mitigation helps companies assess risk areas and plug-in any lacunae that could act as potential attack vectors. It also enables companies to build strong customer relationships that can help increase revenue and grow the business.

Benefits of fraud mitigation

Fraud mitigation is essential to reducing the risk of fraud by identifying risky users. This also allows businesses to understand good customers and generate more sales opportunities with them. Once the fraud mitigation processes are in place, companies can reduce false positives and deliver a great user experience for genuine customers.

Some of the benefits of fraud mitigation are as identified below:

- Improve approval rates: Automated verification allows real-time risk assessment which allows quick approvals for genuine customers, thereby augmenting revenues.

- Reduce fraud risks: By identifying fraudulent activities early in their tracks, appropriate countermeasures can be deployed to stop bad actors from proceeding any further, which improves protection for good users.

- Optimize customer experience: By reducing the risk to the customers and improving their account security, businesses can deliver great user experience, which helps build customer loyalty.

- Strengthen brand equity: Businesses can protect their brand image with fraud mitigation as it minimizes the chances of the business being spoken of badly about publicly.

- Prevent chargebacks: Fraudulent transactions can increase the cost of chargebacks and other associated fees. This can result in loss of revenue and annoyed customers. Fraud mitigation helps minimize unauthorized transactions, thereby preventing losses due to chargebacks.

Create a strong fraud mitigation strategy

The cost of fighting fraud is steadily increasing as bad actors leverage the latest technologies and tools to launch complex attacks. Fraud mitigation can be an effective step in minimizing these costs. However, it is imperative that companies create well thought-out strategies for effective fraud mitigation.

Some of the key considerations for an efficient fraud mitigation strategy include:

- Risk assessment: Begin with clearly understanding and defining the risks that the business faces. Identify the types of fraud schemes that the business may be susceptible to. For instance, account takeover, fake new account registration, etc.

- Assessing security posture: Once potential risks are identified, it is time to review the fraud defense mechanisms in place and understand how effective they are in mitigating evolving threats. Consider simulating a fraud attack to assess the efficacy of the current fraud mitigation controls.

- Deploying robust fraud mitigation controls: If the current fraud mitigation controls are unable to adapt to the evolving threats, consider upgrading or outsourcing to a reliable fraud mitigation vendor, such as Arkose Labs.

- Assigning roles: Clear segregation of roles with accountability is fundamental to effective fraud mitigation.

- Reporting mechanism: Continuously review results to improve future fraud mitigation efforts.

- Continuous monitoring: Remain ever-vigilant of the in-platform activities of all users to detect anomalies and take prompt action.

Best practices for fraud mitigation

As fraud continues to grow unabated, further fueled by technological advances and commoditized tools, businesses must look to prioritize fraud mitigation. Proactive fraud mitigation can enable companies to remain competitive and build customer trust.

Some of the best practices for fraud mitigation that businesses may consider implementing include:

- Risk assessment: Identify areas and touchpoints vulnerable to risks and enforce fraud mitigation policies.

- Strategizing: Create a data-backed strategy to inform fraud mitigation decisions.

- Using targeted friction: Choose friction levels according to risk assessment and risk score of each user so as not to disrupt user experience.

- Outsourcing: Partner with a reliable vendor to supplement fraud mitigation efforts.

- Continuous monitoring: Vigilance throughout customer journey is imperative to spot devious patterns and behaviors indicative of fraud to intervene in real-time.

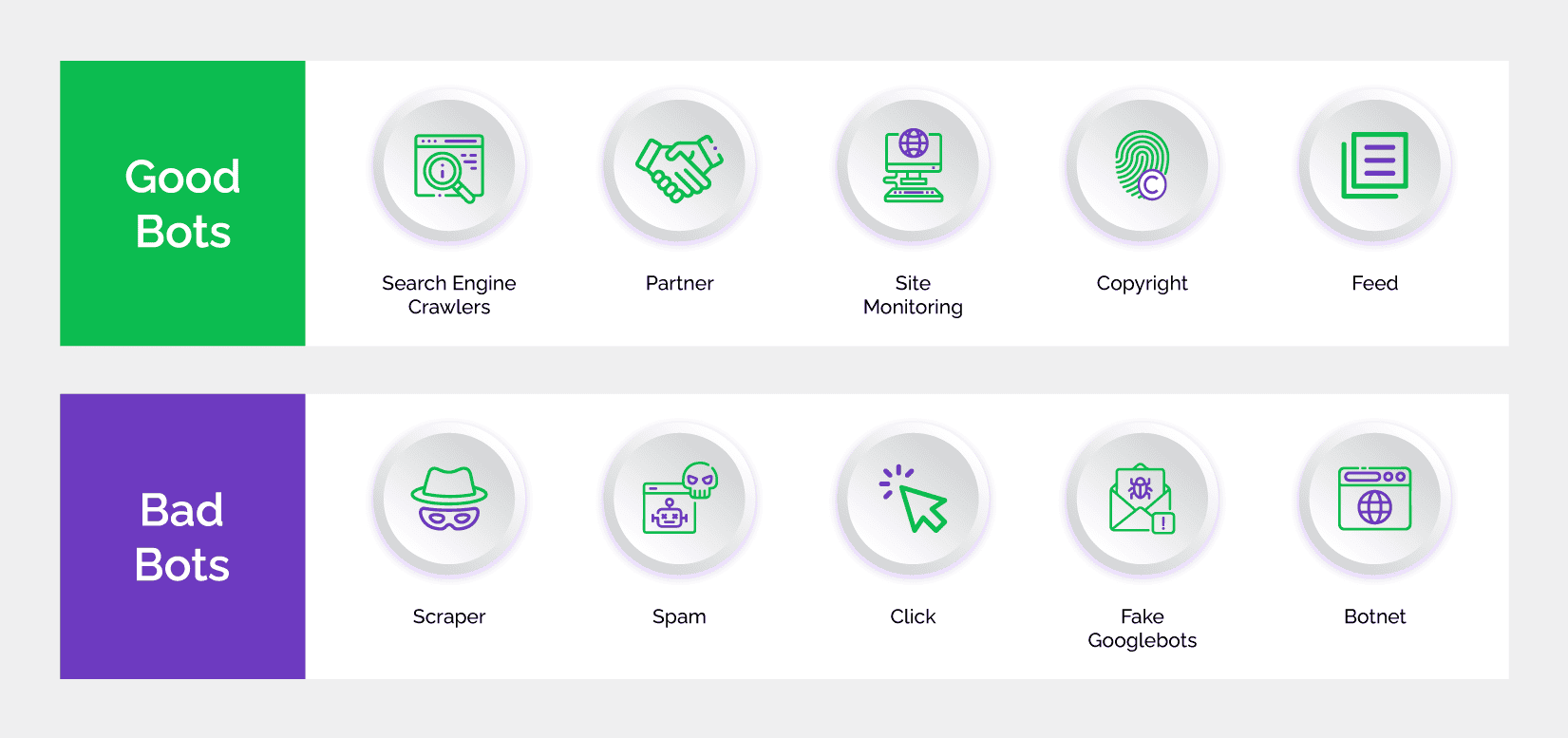

- Leveraging technology: Automate user verification processes for superior bot management, faster due diligence, fewer manual reviews, and timely compliance to prevailing regulations.

Choose Arkose Labs for effective fraud mitigation

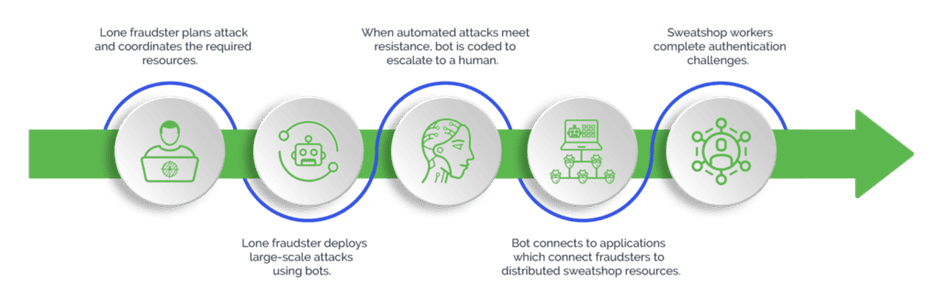

Arkose Labs follows an innovative approach for fraud mitigation that protects businesses from automated bot attacks and malicious human fraud farms, while keeping genuine users at the forefront.

Instead of blocking users, Arkose Labs provides them with an opportunity to prove their authenticity. Based on real-time risk assessment, users are required to solve Arkose Matchkey challenges. While genuine users may not encounter the challenges at all, they can solve them with ease. However, the case is not the same for bots and malicious users.

MatchKey challenges are resilient to even the most advanced automatic solvers and would require enormous amounts should an attacker try to create automated solvers for the numerous versions of each challenge. Delay in clearing the challenges at scale, additional investments and dwindling returns make the attack financially not worthwhile, forcing attackers to give up for good.

Arkose Labs provides its partners with long-term protection from known and new threats with professional services. By sharing raw signals, attributes, data-backed insights, and 24x7 support Arkose Labs empowers security teams to thwart evolving threats as they arise.