What is fraud detection?

Fraud detection is the process of using tools and solutions to identify digitally executed attacks and take remedial steps to mitigate financial and reputational losses. Since cyberthreats are pervasive across industries, businesses are making all-out efforts for effective fraud detection.

In recent years, fraud detection has evolved to keep pace with the growing sophistication of digital attacks. From manually reviewing every incoming user, fraud detection has now become automated with modern fraud detection solutions using artificial intelligence and machine learning driven rules to instantaneously detect anomalies and flag suspicious users for further investigation.

Common types of fraud

Digital channels have created innumerable opportunities for bad actors to launch cyberattacks for monetary gain. There are many ways bad actors attack digital businesses.

Depending on the target business, cybercriminals mobilize their resources and adapt the attack tactics. However, there are some attack techniques that remain common, as described below:

- Fake account creation: Bad actors use stolen or fake user credentials to register new accounts. Since businesses are making the sign-up process easier in order to acquire more customers, bad actors are able to exploit this convenience to get onboarded. These fake accounts can then be used to power numerous types of attacks such as money laundering, money muling, bonus abuse, phishing, spam, and so forth.

- Account takeover fraud: Using verified stolen credentials, attackers gain unauthorized access to genuine user accounts. These compromised accounts serve as the launchpad for a plethora of attacks.

- API fraud: APIs that allow businesses to open up their services are a new attack surface.

- Credit card fraud: Bad actors use stolen credit card details for card-not-present (CNP) fraud to buy products or services. When the genuine cardholder disputes the purchase, the merchant must bear the burden of chargebacks and the related expenses.

- Bonus abuse: Fraudsters use fake or compromised user accounts to abuse signup promotions or loyalty rewards.

- Friendly fraud: When genuine consumers dispute a purchase with a malicious intent to claim refund.

- Return fraud: Customers abuse the return policies of eCommerce companies by using the product for some time and returning it within the return period. Return fraud is also used to avail of discounts on bulk purchases and then returning the product.

- Delivery fraud: Bad actors use stolen user details to purchase items online and have them delivered at a different address. Delivery fraud is also when customers after receiving the items claim that they were not delivered.

- Fake reviews and ratings: Consumers tend to make online purchases based on the reviews shared by other customers. Bad actors write fake reviews and leave false ratings to skew the results, usually with the intent of tarnishing the image of the seller.

- IRS fraud: International revenue sharing fraud is when bad actors forward calls to a distant destination where it is expensive to call and make profits through a revenue-sharing arrangement.

To fight the menace of fraud, digital businesses are looking to implement fraud detection software that help manage risks and define strategies to combat growing threats. However, there are several challenges they face in fraud detection.

Challenges in fraud detection

Fraud detection can yield effective results only when businesses are able to identify the threats they face and create robust frameworks – complete with solutions, strategies, and policies – to address them. Some of the common challenges that businesses face in their fraud detection efforts include:

- Identifying pain areas: Often, due to lack of adequate and granular insights, businesses do not get a clear picture of the unique risks they face.

- Planning: Depending on the risks identified and the regulations they must comply with, businesses need plans for proactive fraud detection. However, these plans must be flexible to accommodate regulatory changes and evolving threats.

- False positives: Inability to identify potentially revenue-generating users and flagging them as risky. This can result in customer annoyance and damage to business reputation and of course, revenues.

- User experience: Most businesses find it difficult to balance fraud detection with user experience. They either use an iron hand or are too lenient while verifying users. Both these situations are unfavorable as there is too much friction in the first approach whereas the second approach opens up the gateways for bad actors, degrading digital experience for genuine users, both ways.

- Data analysis: Businesses need to harness and analyze large volumes of data to be able to gather actionable insights. Often, the data is siloed, low quality or dated, which can adversely impact analysis and impede fraud detection efforts.

- Review time: Customers expect instant response to their requests. This leaves businesses with little to no time to adequately verify user claims, allowing bad actors to take advantage and sneak into the business network.

- Multiple devices: Customers use different devices – including IoT-driven smart devices – to access digital services, which results in proliferation in the attack vectors making fraud detection difficult for security teams.

- 24x7 vigilance: Using the internet, bad actors can launch attacks any time and round-the-clock, making fraud detection difficult for security teams that must ensure 24x7 monitoring and vigilance.

- Technical debt: Often, businesses use point solutions to address specific problems. This can mean an accumulation of disparate solutions being used to resolve multiple issues. Since these solutions work standalone and do not communicate with each other it can lead to information overload and technical debt, impeding effective fraud detection efforts.

- Legacy solutions: Outdated or traditional solutions are no longer capable of fighting cyberattacks that continue to grow in complexity and sophistication. These subpar solutions can increase risks to businesses rather than mitigating them.

Why is fraud detection important?

Fraud plagues digital businesses of all sizes. In recent years, fraudulent activities have surged, owing to a greater influx of users in the digital realm. Greater the volume of users, higher the opportunities for bad actors to attack and make money.

Businesses and consumers lose billions of dollars every year to fraud. Businesses not only suffer direct financial and reputational damages but must also bear covert costs due to fraudulent activities. These include costs incurred on increased customer support, infrastructure to support this deluge of customer tickets, account restoration, password reset, refunds, loss of productivity and so forth.

Affected customers become vulnerable to repeat fraud, which can result in irreparable damage to their digital identities and taking a mental toll. They may find it difficult to seek credit and may even be barred from transacting online. In worst cases, customers may face legal action and penalties for crimes they did not even commit.

Therefore, fraud detection is critical to help protect the interest of businesses and genuine consumers.

How fraud detection works

Fraud is a moving target. It involves a number of people and activities that make fraud prevention difficult. Therefore, to tackle fraud, businesses must adopt agile fraud detection approaches that can swiftly adapt to the evolving attacks.

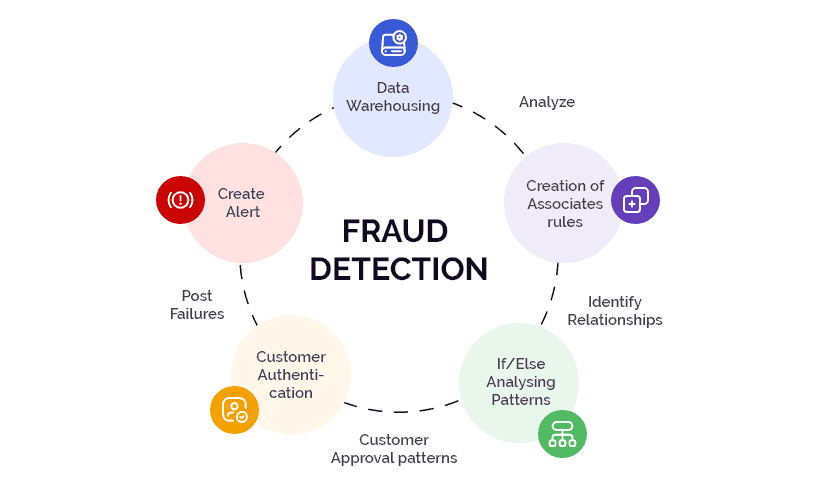

Fraud detection should be an ongoing process comprising continuous monitoring, analysis, and risk decisioning, complete with the ability to incorporate feedback to help improve future fraud detection efforts.

Advancements in technology such as artificial intelligence, machine learning, behavioral biometrics, and big data analytics, among others, can help gain insights into user behaviors, detect anomalies, and make data-back decisions for efficient fraud detection. Fraud detection techniques, that leverage adaptive and predictive analytics, can help assign risk scores and monitor in-platform user activity to identify suspicious activities in real-time, enabling businesses to take proactive fraud detection measures and improving account security of their customers.

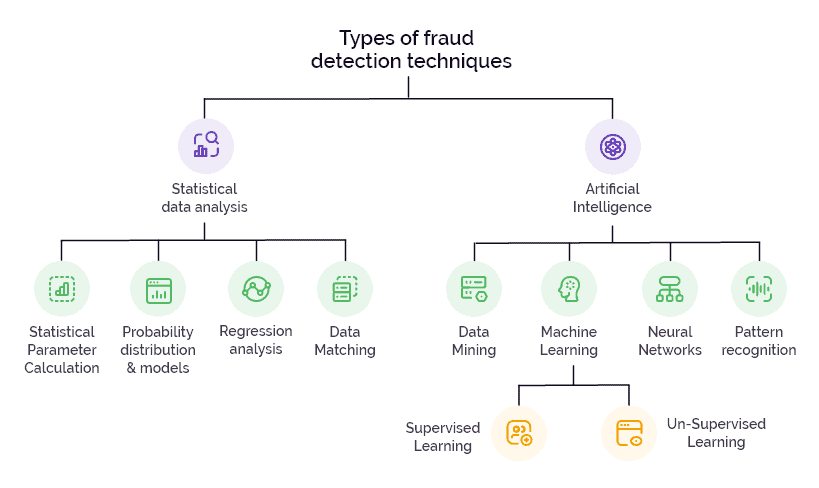

Some of the techniques used in fraud detection include data mining, neural networks, ML algorithms, supervised and unsupervised learning, pattern recognition, link analysis, sequence matching, and so forth.

Elements of a fraud detection framework

Fraud detection is a continuous process which involves several elements. It is essential that businesses create a robust fraud detection framework that facilitates smooth functioning of all these elements.

Some of the key elements to be considered for a fraud detection framework include:

- Strategy: A well defined strategy that lays down clear policies, procedures, processes, and accountabilities. The strategy should be flexible to incorporate updates and improvements continually.

- Data: Promote the use of real-time data.

- Digital intelligence: Uses digital intelligence to verify user identities.

- Human experts: For critical or unusual cases that automation refers for manual review.

- Reporting: An elaborating documentation and reporting mechanism that provides granular insights to continuously improve fraud detection efforts.

- Compliance: Fraud detection efforts should make compliance to evolving regulations easier and faster.

- Training mechanism: To train all employees – and not just the security teams – on the prevailing fraud types – such as business email compromise, authorized push payment (APP) fraud – tips to identify them, and ways to report them.

Best practices for fraud detection

The latest digital technologies are making it possible for businesses across industries to identify risks and fraudulent activities to enable deploying appropriate countermeasures.

Technology-driven fraud detection software help businesses accurately identify and stop risky users in real-time before they can make any headway. Some of the best practices that digital businesses can adopt to improve their fraud detection efforts include:

- Risk profile: Assessing the areas in business that are most likely to face attacks and creating a potential fraud risk profile.

- Analyze all data: Avoid using random data samples for analysis. Instead, use all available data for accurate and data-backed analysis to obtain a clear picture of fraudulent activities.

- Continuous monitoring: Set up scripts that monitor all user activity and flag anomalies for round-the-clock protection against attack attempts.

- ML rules: Use machine learning rules to automate fraud detection and handling. This will deliver faster, more accurate results and alleviate the burden of manual reviews.

- Data: Leverage internal as well as external data sources – government records, third party data providers, etc – to strengthen fraud detection.

- Processes: Streamline fraud detection processes using case management solutions.

- Review: Adapt to the evolving threats by reviewing the fraud profiles and updating rules and controls that may not be working properly.

Useful fraud detection and prevention techniques

There are several techniques that prove useful in fraud detection. Businesses may need to use a combination of several techniques to be able to fight growing fraud effectively.

Some of the commonly used techniques for fraud detection are:

- Data enrichment: Supplementing available consumer information with data from external sources to get a clear picture of the user.

- Social media lookup: Looking up social media profiles of a user across social platforms can provide a treasure chest of information that can help verify a user accurately.

- Real-time risk assessment: This is critical to improve accuracy of user verification, and eventually approval or rejection of a user’s actions.

- AML lookup: Businesses in highly regulated industries – such as financial services and gaming – must comply with numerous regulations, else face harsh penalties and legal action. AML lookup can help these businesses comply with mandatory CDD and EDD compliances.

Why choose Arkose Labs for fraud detection?

Digital enterprises today are mindful of the critical role fraud detection can play in powering the growth of their businesses and protecting their customers from growing cyberthreats. Top global businesses choose Arkose Labs for superior fraud detection as Arkose Labs goes a step further to deter fraud, ensuring protection from evolving threats in the long-term, while remaining compliant with jurisdiction-specific regulations.

With Arkose Labs, businesses are able to significantly reduce the chances of fraud, while reducing false positives and enhancing user experience. This is because Arkose Labs acts as a protective shield between the business and the attackers by routing the incoming traffic through its own network. As a result, the business entity can continue with the activities unhindered while Arkose Labs takes on the bad actors.

An AI-powered risk engine assesses each incoming user on several digital parameters to assign a risk score in real time. Based on this risk assessment, users are presented with an enforcement challenge. While good users may not even encounter a challenge and continue with their digital journeys, bots and scripts fail instantly.

Arkose Matchkey challenges are supremely difficult for automatic solvers, bots and scripts to clear at scale. Even malicious humans must spend enormous amounts of time and resources trying to automate the several versions of each Arkose Mathkey challenge. This causes delay and prevents attackers from scaling up the attacks, severely impacting the returns from the attack. In the absence of any financial returns in sight, attackers move on for good.

Leveraging superlative detection techniques, Arkose Labs reduces the burden on security teams, while also sharing raw signals and attributes to adapt to the evolving threats. When security teams have the required insights into why a session or user was marked risky, they are better equipped to improve their future fraud detection efforts with explainable decisioning.