Card Not Present (CNP) Fraud Prevention

Card not present fraud prevention is critical to protecting users and businesses from financial losses and other related hardships. Card not present (CNP) fraud is a term used to define fraudulent digital transactions made without using a physical card.

Realizing the importance of card not present fraud prevention, businesses are taking measures such as creating a CNP fraud mitigation framework and using CNP fraud detection software to effectively deal with suspicious transactions and prevent this threat.

What is card not present fraud?

Card not present fraud refers to illegitimate payments where the physical payment card is not present during the transaction. CNP payments usually take place online or through the phone. Since CNP payments only require the card details, and not the physical card itself, bad actors find it easy to make fraudulent online purchases using stolen card details. They can easily access card details from data breaches, hacking, phishing campaigns, website scraping, and several other devious methods.

Bad actors adopt various ways to execute CNP fraud. Some of the common methods include:

- Online Purchases: Using stolen credit card information, fraudsters make unauthorized purchases on e-commerce websites.

- Phone Orders: Posing as legitimate customers, fraudsters place orders over the phone and provide stolen card information at the time of payment.

- Mail Orders: Intercepting the card information that customers share with merchants over the email, bad actors use these details for fraudulent purchases.

- Recurring Payments: Fraudsters may use stolen payment card information to set up fraudulent recurring transactions by targeting recurring payment arrangements, such as subscriptions or memberships.

- Card-Not-Present Skimming: Skimming is a technique whereby fraudsters capture card information during digital transactions without accessing the physical card. They use skimming devices or malware to capture the information and then use it for CNP fraud.

How card not present fraud works

CNP fraud entails several steps. It begins with fraudsters stealing card details through several means such as data breaches, buying databases of stolen data from the dark web, phishing and social engineering campaigns that trick users into revealing their information, skimming and using malware.

Once attackers have the requisite information, they look for vulnerable merchants. Attackers exploit payment systems to place fraudulent orders through online and phone-based purchases on ecommerce platforms.

The attackers then exploit the weak security measures such as limited user authentication and inadequate verification mechanisms to complete the fraudulent transactions using stolen card numbers, expiry dates, and CVV. Scammers may choose to have the purchased items delivered at different addresses or use drop-shipping services to avoid suspicion.

On successful completion of the transaction, when the rightful owner of the card notices the unauthorized charges, a chargeback is initiated with their bank or credit card issuer. This results in chargebacks and financial losses for the merchant, who may have to refund the customer and suffer related chargeback fees.

How CNP fraud affects businesses

CNP fraud causes direct financial damages to the businesses. Affected merchants bear the chargebacks, as they must reverse the funds and return them to the cardholders. This means merchants face double the loss as they not only lose revenue from the fraudulent transaction but must also bear chargebacks and other related fees.

To mitigate CNP fraud risks, businesses must invest in credit card fraud detection software and CNP fraud solutions. They must also deploy additional measures for improved identity and access management, and keep up with evolving security technologies. These result in additional investments, thereby raising operational expenses.

Further, affected businesses experience operational disruptions and incur additional operational costs to investigate and resolve fraudulent transactions. They must allocate resources and team members to handle chargebacks, irate customers and potential legal action.

CNP fraud also causes reputational damage, which is rather long-term. It results in erosion of customer trust, as customers expect businesses to protect their data and information. In worst cases, unhappy customers may choose to switch over to competitors, causing revenue losses to the impacted business. In the age of social media, negative comments can quickly spread and affect business growth.

Inadequate card not present fraud detection may expose a business to legal consequences. Failure to protect consumer data and comply with regulations such as Payment Card Industry Data Security Standard (PCI DSS) and other jurisdiction-specific regulations can attract regulatory fines and penal action.

How CNP fraud affects consumers

CNP fraud not only affects businesses, it also affects consumers. Affected consumers may experience the negative impact of card not present fraud in several ways. For instance, consumers may be held liable for chargeback fraud and the losses incurred due to fraudulent transactions, if fraud is not reported in time. This may result in direct financial losses to the consumers for no fault of theirs and adversely affect their ability to meet financial obligations. They may suffer from insufficient funds, overdraft fees, or credit limit restrictions, jeopardizing their financial lives.

Consumers must invest time and effort to deal with the complexities arising from CNP fraud. For instance, they may need to contact their bank or credit card issuer, report the unauthorized transactions, provide documentation, and go through the process of disputing the charges to resolve the issue. This can be time-consuming and frustrating, and take a toll on the mental well-being of the consumers. In worst cases, consumers may become hesitant to engage in online transactions, disrupting their digital lives in the process.

In addition, CNP fraud may open up the possibility of identity theft. This is because fraudsters may be able to access consumers’ other personal and financial information. As a result, consumers may need to monitor their credit reports, place fraud alerts, or freeze their credit files as additional security measures, which can cause inconvenience.

What is CNP fraud prevention?

In an increasingly digital world, growing volumes of digital transactions are fueling the rise in CNP fraud that cause massive losses to businesses and consumers alike. CNP fraud prevention refers to the host of measures taken along with deployment of CNP fraud detection software and CNP fraud mitigation framework to prevent CNP fraud.

CNP fraud prevention is critical to protecting businesses and consumers from financial losses. It is also useful in improving security of critical data, preserving customer trust, and complying with the evolving regulations.

Why CNP fraud prevention is critical

Rising prevalence of CNP fraud allows criminals to exploit vulnerabilities in online payment systems at will. CNP fraud prevention is critical to putting an end to criminal activity and safeguarding financial interests of businesses and consumers. Card not present fraud prevention is also crucial for preserving brand equity, maintaining customer trust, and complying with regulations. Card not present fraud detection improves operational efficiency and mitigates the risks associated with CNP fraud.

With robust CNP fraud protection mechanisms, businesses can reduce fraudulent transactions, prevent chargeback CNP fraud and avoid potential liabilities. CNP fraud detection enables businesses to improve operational efficiency by reducing the time and resources wasted in handling fraudulent transactions, chargebacks, and customer disputes. Using CNP fraud solutions, they can streamline business operations, judiciously allocate resources to focus on core activities, and improve productivity.

Further, by proactively implementing CNP fraud detection software, businesses can demonstrate their commitment to safeguarding customer information. They can enhance their consumers’ account security and protect them from unauthorized charges and other hardships. Deploying CNP fraud solutions can help enhance data security and prevent compromise of sensitive information, allowing businesses to remain compliant with the prevailing regulations and avoid possible legal action. This helps enhance reputation and strengthen customer trust, leading to repeat business and positive word-of-mouth recommendations.

Methods to prevent CNP fraud

Various CNP fraud prevention methods are available to combat CNP fraud. These include card verification codes (CVV), address verification services (AVS), 3D Secure protocols and advanced CNP fraud detection systems. In addition, strong authentication methods such as multi factor authentication (MFA), ongoing transaction monitoring, and consumer awareness programs can play a crucial role in CNP fraud detection and mitigation.

Some of the effective methods to prevent CNP fraud are as listed below:

- Strong Authentication: Implement multi-factor authentication (MFA) for online transactions to add an extra layer of security and make it harder for fraudsters to impersonate genuine users. Consider using passwords, SMS verification codes, biometrics, or hardware tokens to verify the identity of the cardholders.

- Address Verification Services (AVS): AVS can help verify the cardholder's billing address provided during the transaction. Use AVS to compare the address on file with the card issuer to the one provided by the customer. This will help detect anomalies indicative of fraudulent activity.

- Card Verification Code (CVV): Require the card verification code (CVV), a numeric code printed on the payment card, for every CNP transaction to verify that the person making the transaction actually possesses the physical card.

- Tokenization and Encryption: Use tokenization and encryption techniques to secure sensitive customer data. Tokenization replaces card details with a unique identifier (token), while encryption scrambles the data to make it unreadable to unauthorized individuals. This helps prevent misuse of information even if fraudsters are able to access stolen card details.

- CNP Fraud Detection Systems: Deploy technology-driven card not present fraud detection systems to flag suspicious patterns and anomalies in transaction data for timely intervention and mitigate risks in real-time.

- Transaction Monitoring: Implement automated transaction monitoring such as transaction velocity filters to identify and block suspicious activities in real-time. These activities may include unusually large transactions, multiple transactions from different locations, or irregular purchasing patterns.

- Update Software: Keep the security apparatus up-to-date with secure payment gateways, firewalls, and anti-malware software. Apply the latest security patches and updates to plug in any lacunae vulnerable to exploitation.

- Partner with a Reliable Vendor: Conduct due diligence of security vendors before partnering with them. Evaluate their ability to protect sensitive information and adhere to industry best practices.

Trust Arkose Labs with CNP fraud prevention

Global businesses trust Arkose Labs for CNP fraud prevention due to its innovative approach that is tough on bad actors but keeps the interest of good consumers at the forefront.

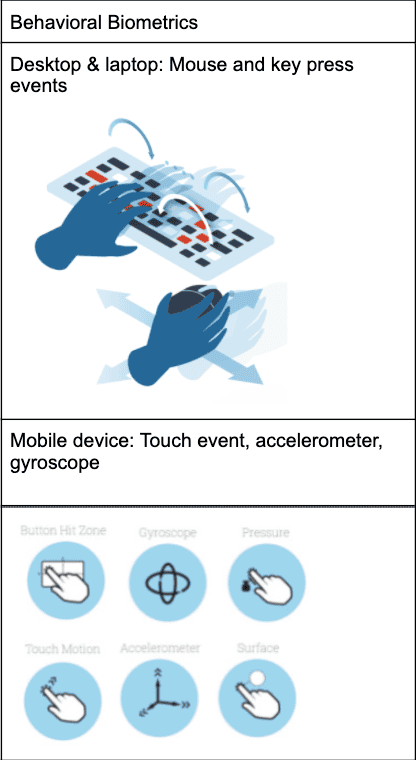

Using behavioral biometrics, email intelligence, device intelligence, advanced machine learning algorithms, and a host of latest technologies, Arkose Labs segregates all incoming traffic into human and non-human traffic. Based on real-time risk assessment of each user, Arkose Labs presents targeted friction in the form of adaptive authentication CAPTCHAs. These challenges obstruct suspicious users but allow genuine users to pass through.

Automated bot traffic fails to clear Arkose Matchkey challenges, simply because these proprietary 3D puzzles are resilient to even the most advanced bots with human-like capabilities. Persistent malicious humans, however, continue to be challenged with incrementally complex challenges that keep growing in volumes, too. This delay in clearing the challenges at scale disrupts the possible returns from the attack and makes it financially worthless, forcing attackers to give up for good.

Businesses are able to strike a balance between CNP fraud prevention and a seamless user experience, while alleviating the burden of CNP fraud detection from their internal security teams. Arkose Labs leverages threat intelligence from its global network and provides round-the-clock support to help its partners proactively adapt their fraud prevention strategies for future-proof protection from CNP fraud tactics.