Card Cracking 101: What You Need to Know

Have you heard of the term "card cracking?" The scam involves fraudsters luring unsuspecting victims into providing their bank account information and debit card details, which are then used for illegal activities such as money laundering and identity theft. Here, we will provide a comprehensive guide to card cracking, what it entails, how it works, and most importantly, how you can avoid falling prey to such scams.

What is Card Cracking?

Card cracking is a type of account takeover fraud in which a criminal gains access to a victim’s account and uses it for nefarious purposes. It often begins with criminals targeting vulnerable individuals—such as college students, young adults, and single parents—on social media platforms. Criminals use various tactics to obtain bank account details and illegally deposit phony checks into the victim's account. To prevent such scams, it is essential to be cautious about sharing personal information online, monitor bank accounts regularly, and report any suspicious activity to your bank or law enforcement.

ON DEMAND: The Anatomy of an Account Takeover Attack

WATCH NOW

How Does Card Cracking Work?

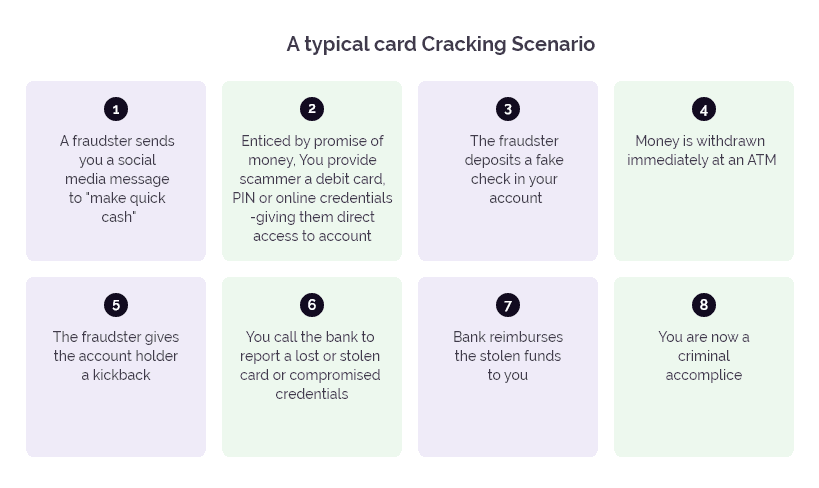

The process of card cracking typically begins with the criminal obtaining stolen credit or debit card information, either through hacking, phishing, or other means. Once they have this information, they will often recruit others to help them carry out the scam. These individuals are sometimes called “runners,” and they are responsible for withdrawing cash from ATMs or making purchases with the stolen cards.

The runners are typically recruited through online solicitation on a social media site, where the criminal offers them easy money (a kickback), in exchange for their help. The runners may be asked to provide their own bank account information or to open new accounts specifically for the purpose of receiving the fraudulent funds. The criminals behind the scam will then withdraw the money to use as they wish and encourage the runner to report the card to the bank as stolen in order to be reimbursed.

Runners are promised extra money in exchange for letting the fraudsters use their bank accounts, but this ultimately leads to severe consequences. Not only do victims face overdraft fees and damaged credit scores, but they may also be held legally responsible for any criminal activity that takes place using their account.

Carding vs. Card Cracking

Carding and card cracking are both types of credit card fraud, but they differ in their methods and objectives.

Carding involves the use of stolen credit card credentials to make unauthorized purchases online. Carders use various techniques to obtain credit card data, including hacking into databases, skimming credit card information from point-of-sale (POS) terminals, and purchasing stolen data on the dark web. Once they have the credit card information, criminals may use it themselves to make purchases or sell it to others for a profit.

In contrast, card cracking is a type of fraud that involves tricking victims into giving up their own credit card or bank account information. Scammers typically target young people or those with poor credit histories, promising them quick cash in exchange for their credit card details. They may advertise on social media or through other channels, offering money or other incentives to entice victims to participate.

How to Identify and Avoid Card Cracking Scams

In card cracking scams, criminals often use tempting offers of easy money to lure unsuspecting victims into their trap. Here are just a few ways they do it.

Suspicious Recruitment Ads

Recruitment ads in social media posts promising easy money and flexible working hours are often used to lure unsuspecting victims into card cracking scams. These ads can be found on social media platforms, job boards, or even through direct messages. The scammers may pretend to represent a legitimate company or offer vague details about the job requirements to entice potential recruits.

People should be cautious of unsolicited recruitment messages and thoroughly research the company before responding to any offers. Legitimate job opportunities will never require access to a personal bank account or ask you to perform illegal activities.

“Too Good to Be True” Offers

Beware of offers that seem too good to be true, especially when they are related to financial gain. Scammers often use these offers to entice victims into card cracking schemes by promising extra cash, gift cards, or other benefits. They may also ask for your account information, debit card, and PIN number in exchange for access to fast cash or other incentives.

Remember that no legitimate company will request sensitive information and that it's always essential to be vigilant and skeptical of such offers.

Phishing Attacks

Criminals who engage in card cracking scams often attempt to trick victims into providing personal information by sending unsolicited messages or requests. This is called phishing. For example, attackers may send emails or text messages that appear to be from a legitimate financial institution, such as a bank or credit card company, requesting that the victim provide their credit card number or other sensitive data. They may offer fake incentives and promotions to lure victims into giving up sensitive information. The message may include a link to a fake website that looks legitimate but is actually a fake designed to steal information.

Consequences of Involvement in Card Cracking

By giving access to their bank accounts or credit cards, victims of these scams put themselves at risk of having their funds stolen by scammers. Additionally, participating in card cracking can lead to repercussions, such as legal charges, fines, and imprisonment. Moreover, those caught engaging in such fraud may struggle with damaged credit scores and limited access to loans or credit facilities in the future.

Card Cracking: Prevention & Detection

Detecting card cracking can be difficult, as the scammers are often very sophisticated in their approaches. However, there are some signs that businesses can look out for that may indicate a card cracking attack.

One common indicator of card cracking is a sudden increase in the number of transactions on a particular account. If you notice that a particular account is being used more frequently than usual, it may be a sign that the card has been stolen and is being used for fraudulent purposes.

Another sign to look out for is a sudden increase in the number of chargebacks or disputes. If customers are reporting unauthorized transactions on their accounts, it may be a sign that their card information has been stolen and is being used for card cracking.

Finally, you may notice that a particular individual or group of individuals is using multiple cards to make purchases or withdraw cash from your account. This could be a sign that they are involved in a card cracking scheme.

Social media sites, banks, and other financial services companies have a multitude of ways to detect card cracking scams.

Social Media Platforms

Social media recruitment ads may seem like an easy money-making opportunity at first, but they can lead to serious legal and financial consequences. It is important for social media companies to take action to prevent card cracking recruitment. Here are 7 ways social media platforms can help prevent card cracking initiatives:

- Filter content: Social media platforms use content filtering algorithms to scan messages and suspicious posts for specific keywords and phrases commonly associated with card cracking, such as "quick cash," "easy money," or "debit card."

- Monitor user activity: Social media companies can use machine learning algorithms to analyze user activity and detect suspicious behavior patterns or fraudulent activity, such as a high volume of direct messages sent to different users or a sudden increase in followers.

- Disable suspicious accounts: If social media companies detect suspicious activity, they should disable the accounts responsible for it. They can also report the activity to law enforcement.

- Analyze images and videos: Social media platforms also use image and video analysis technology to detect images or videos that may contain card information or other sensitive information.

- Provide reporting tools: Social media platforms have reporting tools that allow users to report suspicious activity, including card cracking messages. When users report suspicious messages, the platform can investigate the matter and take appropriate action.

- Educate users: Social media companies can educate users on how to protect their personal information and how to recognize card cracking scams. This can be done through in-app notifications, pop-ups, or educational videos.

- Partner with financial institutions: Social media companies can also partner with financial institutions to detect and prevent card cracking. By sharing data, they can identify patterns of suspicious activity and take action to stop it.

By detecting and stopping card cracking early, social media platforms can help prevent their users from being scammed and protect their platforms from being used for illegal activities.

Banks & Financial Institutions

Banks' detection techniques include a combination of advanced technology, data analysis, and collaboration to detect and prevent card cracking. By detecting fraud early, they can minimize the impact on their customers and prevent criminals from profiting from these scams.

- Monitor account activity/transaction data: Banks use advanced software to monitor their customers' account activity, looking for unusual patterns of transactions, such as a high volume of cash withdrawals or fraudulent check deposits. If the activity is suspicious, the bank will investigate further.

- Collaborate with other banks and law enforcement agencies: Banks collaborate with other banks and law enforcement agencies to share information about suspected card cracking activity. This helps them identify patterns of behavior across multiple institutions and take action to prevent further fraud.

- Use machine learning algorithms: Banks use machine learning algorithms to analyze large amounts of data and identify patterns of behavior that may indicate card cracking. These algorithms can detect fraud faster and more accurately than traditional methods.

Card Cracking & Bots

Scammers may use automated software, known as bots, to carry out card cracking fraud on a large scale. Bots are computer programs that can perform automated tasks, such as filling out forms, clicking on links, or interacting with websites.

In the case of card cracking, scammers use bots to carry out large-scale attacks on social media platforms. They may create fake accounts or use hacked accounts to post messages or advertisements that offer quick cash or other incentives in exchange for credit card information. Bots can be used to automatically respond to comments or messages from potential victims, making it easier for scammers to reach a large audience.

By using bots, scammers can carry out fraud on a much larger scale than would be possible through manual methods alone. This can make it more difficult for law enforcement or financial institutions to detect and prevent fraud. Bots attacks can also automate the process of withdrawing cash from ATMs or making unauthorized purchases, further increasing the scale and impact of the scam.

Many social media platforms have implemented measures to detect and prevent the use of bots, such as CAPTCHAs or other anti-spam measures. Financial institutions may also use fraud detection algorithms to monitor for suspicious activity and block unauthorized transactions.

How Arkose Labs Can Help

Card cracking is a scam that can have severe consequences for the victim and the perpetrator, as well as for technology platforms where scammers recruit their victims and banks that must address chargebacks and investigate the fraud. No social media platform can be successful if users suspect it is an unsafe space. And of course, preventing attacks and securing accounts is a top concern for banks and other financial services companies.

Arkose Labs Bot Manager offers a unique approach that tackles human-driven and automated fraud and abuse, and eliminates bot activity. A combination of risk-based and step-up authentication stamps out fraud on tech platforms and helps to prevent account takeovers, fake new accounts, spam, and phishing. It also empowers banks, fintechs, and other financial institutions to protect user accounts and eliminate large-scale fraud attacks. And Arkose Labs is the only platform to guarantee protection from bots—it’s backed by an industry-first $1 million warranty against account takeovers and SMS toll fraud.

Book a demo today to learn more!