In today’s digital-first era, businesses that do not grow digitally, run the risk of stagnation and, eventually, failure. However, rapid digital growth can have vastly different meanings for different business. And, the challenges associated with this transformation also differ. To attain sustainable digital growth, digital businesses—whether small businesses, not-for-profit organizations such as credit unions, or technology platforms—can consider some common practices.

A growing business attracts greater fraud

When businesses focus on rapid digital growth, they must also ensure the best possible user experience. They must strive to balance this growth with effective fraud prevention, as it can impact user experience and provide fraudsters with ample opportunities to exploit the business.

They must identify risk areas and define the possible actions to fight these risks. That said, unduly high friction or too many checks can filter out the legitimate users along with malicious users. This can disrupt user experience and weaken the dialogue with the board when trying to convince that all these fraud prevention measures are indeed needed.

As businesses continue to grow in size, the issue of balancing fraud with growth becomes increasingly pertinent. This is because once a business attains a certain size, it must deploy fraud mitigation mechanisms at the same pace and rate as its size. The challenge, however, is that as soon as a business attains a growth milestone, it becomes a much larger and aggressive target for fraud.

Strike a balance between growth and fraud prevention

Regardless of the stage of digital growth a business is in, the need for an enhanced user experience and protecting customers from online abuse are always at the forefront. However, with different customers, each with unique needs, the same checks and measures cannot apply uniformly. Businesses must find micro-segments of users and set the risks based on indices that look beyond the duration the user has been with the business. When the business is smaller in size, it can afford to single out suspicious users and be extra vigilant with them. However, after rapid digital growth, a business attains certain volume and size such that reviewing individual users becomes unsustainable.

At this stage, the sophistication in fraud detection and knowing the customer, as well as risk decisioning for each user becomes critical. Since businesses cannot choose growth over fraud—or vice versa—they must strike a fine balance between the two. This will also help them earn customer trust—a key ingredient for long-term business success.

Key drivers that enable sustained digital growth

As businesses grow in product portfolios and the services offered, they must think about what will differentiate them from the competitors. To sustain rapid digital growth, the key drivers that businesses must put in place are communication and transparency, with all the stakeholders in the business ecosystem. Communication remains central to adapting to rapid digital growth. Over the last decade or so, the communication channels and strategies have evolved. Today, with a few lines of code, businesses can integrate SMS, voice, or video into the business applications and easily talk to their customers.

The other key drivers include:

- The product/service: If the product/service is not good enough, users will not even bother considering a business.

- User experience: Businesses must strive to offer superlative customer experience (even better than the offline world) where users find it easy, intuitive, quick, and relevant to use the product/service.

- Security: Businesses must continue to innovate and improve the product/service such that it prevents bad actors from logging in while protecting authentic users from online abuse and fraudulent activity.

Segregate authentication from access control

In the digital realm, when a user logs into his/her account, the business must consistently understand who the user is—regardless of the platform used to access the product or service. This can be done using unified identity solutions that evaluate digital identities consistently across all environments—whether digital, on phone, or in person.

Today, users expect businesses to be sophisticated enough to know their preferences, behaviors, and hierarchical relationships in order to serve them appropriately. However, with prevalent data privacy and GDPR directives, businesses can only rely on mechanisms like KYC as authoritative sources of information to learn about customer preferences. Further, businesses are becoming aware of the need to separate out authentication from access control, as bundling the two together can negatively impact user experience. In addition to enabling the users to prove their legitimacy, this segregation also helps businesses understand how users interact with the product.

Verify and close the chain

Over the years the concept of identity has changed. Instead of a single user, multiple identities must now be considered. Therefore, to mitigate fraud, prevent money laundering, identity theft, and accounts takeover, businesses must verify whether the users are actually who they claim to be. To do this, they can leverage multiple data sources, analyze parameters such as digital footprint, cookies, IP addresses, velocity, etc, and use tools like multi-factor authentication (MFA). To close the chain, either an email address—that has enough age and indicates that it belongs to an authentic user—or a phone number can be used.

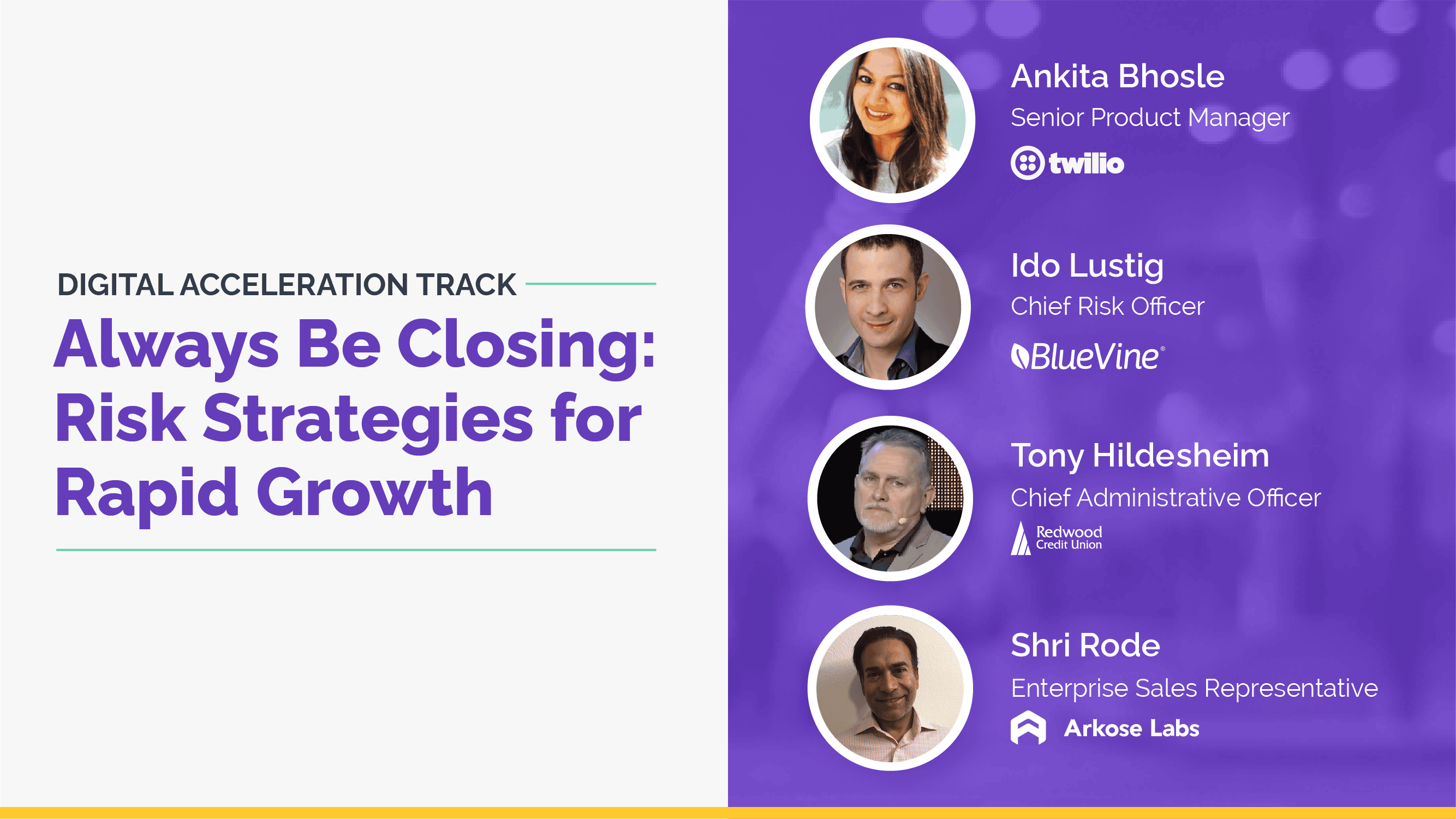

To hear the industry experts talk in-depth about risk strategies that facilitate rapid digital growth, watch the recording of the past Virtual Summit session Always Be Closing – Risk Strategies for Rapid Growth.